Community Contributions

Over the course of 2024, YNCU presented a series of donations to support local causes that align with our community values and giving themes.

LOCAL SMALL BUSINESSES

INDIVIDUALS & FAMILIES IN NEED

MENTAL HEALTH & WELLNESS

As part of our 2024 commitment to invest profits back into our communities, YNCU made donations to select organizations to help them continue offering programs and services to vulnerable groups in our communities.

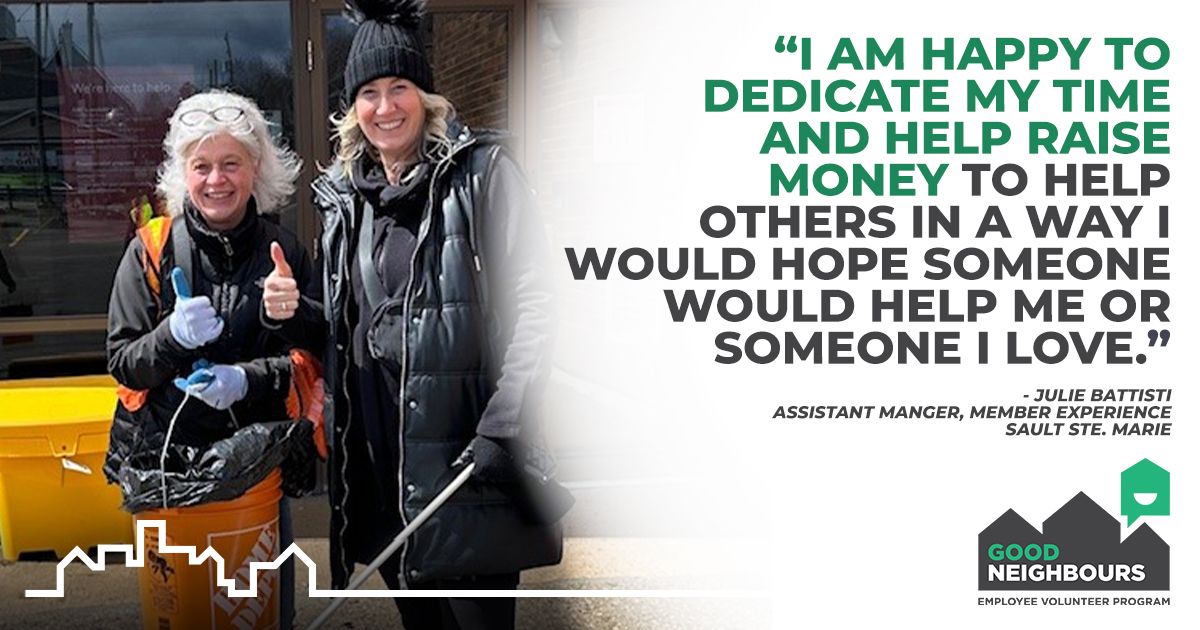

Coldest Night of the Year – Blue Sea Foundation

The Coldest Night of the Year is a family-friendly 2 or 5 km fundraising walk in support of local charities serving people experiencing hurt, hunger, and homelessness.

Each February, tens of thousands of Canadians step outside the warmth and comfort of home to shine a light of welcome and compassion in their communities. Since 2011, the Coldest Night of the Year has raised over $75,000,000 across Canada in 190 Canadian communities – 100% of net proceeds stay local to support our CNOY charity partners.

https://cnoy.org

Waterloo Regional Food Bank

The Food Bank of Waterloo Region plays a pivotal role in the Community Food Assistance Network, a collaborative effort involving over 120 community programs and agency partners. Together, they provide crucial support in the way of meals, shelter, nutrition outreach, counseling, and connections to various support services. A significant portion, 59%, of the food managed and distributed within the network is fresh or frozen, thanks to the fleet of refrigerated trucks and well-equipped storage facilities. Additionally, the Food Bank of Waterloo serves as a trusted source for information on hunger and food insecurity in the Waterloo region. Together, through food and fund drives, YNCU contributed to providing over 1.7 million meals to individuals and families in need in 2024.

https://www.thefoodbank.ca/

KidsAbility Foundation

KidsAbility supports nearly 14,000 children and youth each year through a blend of virtual and in-person services, helping them achieve their communication, social, physical, and behavioral goals in various settings. They provide holistic, family-centered care from birth to age 21, addressing concerns about whether a formal diagnosis exists or not. The mission is to deliver timely and exceptional services, funded by the Ministry of Children, Community and Social Services, purchase-service options, and community generosity. Donations are crucial in supporting life-changing therapy, innovative programs, and cutting-edge technology to enable children to reach milestones sooner and fully engage in the community. KidsAbility is committed to creating an inclusive environment where diversity is celebrated. Together we can build brighter futures for children, youth, and families.

https://www.kidsability.ca/

Anishnabeg Outreach, Kitchener

Anishnabeg Outreach provides Indigenous people with access to culturally appropriate services and strives to support individuals with direction and assistance to overcome barriers. They encourage individual exploration of avenues that will lead to self-sufficiency and success. From the healing activities they provide to the programs and workshops, YNCU is proud to be supporting their initiatives.

https://aocan.org

OK2BEME

OK2BME is a set of supportive services for Two-Spirit, lesbian, gay, bisexual, trans, queer, intersex, asexual (2SLGBTQIA+) and questioning kids, teens, adults, and their families in Waterloo Region.

The OK2BME program consists of three unique areas including confidential counselling services (in person or online), OK2BME Youth Groups for individuals 12-18, as well as public education, consulting and training around 2SLGBTQIA+ issues.

https://ok2bme.ca/

Lansdowne Children’s Centre

Lansdowne Children’s Centre is one of Ontario’s 21 Children’s Treatment Centres [CTCs] and a member of Empowered Kids Ontario (EKO). Lansdowne provides services and supports for over 3,000 children and youth and their families, annually.

Lansdowne provides child development resources as well as supports and services for communication, developmental, and physical needs. Their service region includes Brantford, Brant, Haldimand, and Norfolk counties, and the Six Nations of the Grand River and Mississaugas of the Credit First Nation. Lansdowne currently operates sites in Brantford, Caledonia, Dunnville, and Simcoe.

https://www.lansdownecentre.ca/

Police Pal Program

The London Police Pal Program began on May 30th, 1990 as a way to help young children cope with physical and emotional trauma. This community initiative provides a plush German Shepherd toy dog to young children who may have experienced or be experiencing physical and emotional trauma. The dog acts as a way to distract and provide comfort to a child while a Police Officer is responding to a call.

Read more about how YNCU and the Police Pals are comforting children in a time of crisis